The management of connections between insurance firms and their agents makes agency management crucial to the insurance sector. This includes monitoring the sales and distribution of insurance services as well as activities like hiring, educating, and assisting agents. For insurance firms, efficient agency administration is essential because it may enhance client satisfaction, boost revenue, and simplify operations. Strong agency management procedures are more crucial than ever for businesses in today’s competitive insurance industry. For insurance businesses wanting to enhance their agency management procedures, salesforce might be useful. It has several features that are specially made for operating insurance businesses, including instruments for monitoring performance and controlling commissions.

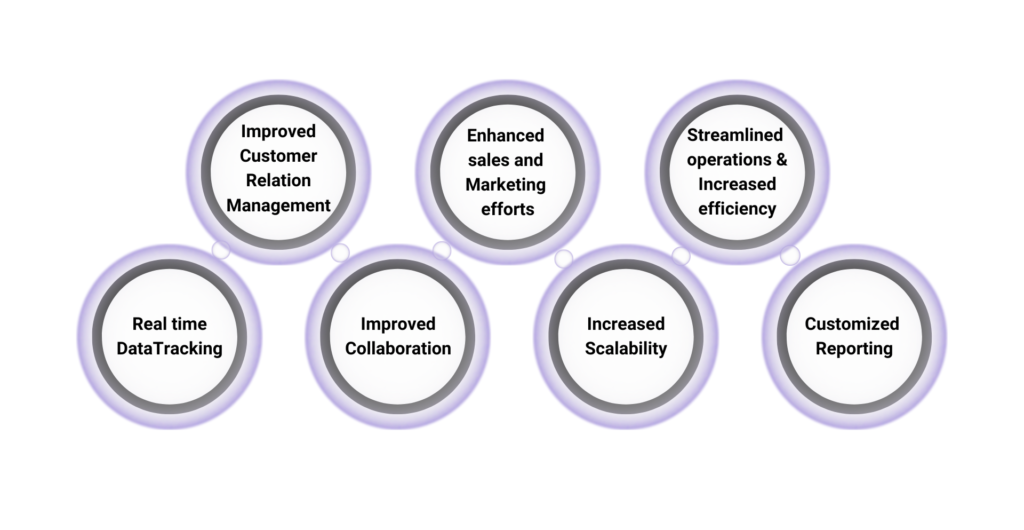

Benefits of Using Salesforce for Insurance Agency Management

- Improved customer relation management

Insurance companies can manage customer interactions and connections in one location due to Salesforce’s CRM capabilities. This can enhance customer service and foster closer relationships with consumers. To improve their sales and marketing efforts salesforce helps insurance companies in specific ways like Lead tracking, Marketing Automation, Sales forecasting, and by integrating with social media.

- Enhanced sales and marketing efforts

Salesforce also provides resources for organizing and monitoring marketing and sales initiatives. This can assist insurance companies in streamlining their sales procedures and looking for the right prospects for development.

- Streamlined operations and increased efficiency

A broad range of Salesforce’s capabilities and solutions can also assist insurance companies in optimizing their processes and boosting productivity. It can assist in tracking commissions and performance, managing agent training and assistance, and managing sales.

- Real-time data tracking

Insurance firms can track customer and agent data in real time with Salesforce, which can help them make better decisions. Salesforce can be used, for instance, to monitor agent performance and highlight areas for development. Insurance companies can improve their decisions and manage their companies more efficiently with the help of real-time data tracking. This includes customer service, sales forecasting, agent performance, and financial tracking.

- Improved Collaboration

Salesforce’s collaboration tools provide great support with which insurance businesses can communicate and work together in real-time from any place. As a result, teamwork and communication inside the company can be improved. The collaboration tools in Salesforce can boost production, collaboration, and communication within insurance organizations.

- Increased Scalability

Insurance companies may scale their operations according to their requirements with Salesforce’s cloud-based technology. This can be especially helpful for businesses that are expanding or going through operational changes. Salesforce’s cloud-based platform’s adaptability, affordability, and dependability can help insurance businesses increase their operations.

- Customized Reporting

Insurance companies may provide personalized reports and evaluate key indicators of performance using Salesforce’s reporting solutions. They can use this to optimize their operations and make data-driven decisions. The reporting features provided by Salesforce can help insurance companies in analyzing their business operations, make data-driven policies, and enhance customer satisfaction.

For insurance businesses trying to enhance their agency management procedures, Salesforce is a powerful resource. While its capabilities for controlling commissions and tracking performance can help organizations streamline their operations and boost efficiency, its CRM, sales, and marketing abilities may assist businesses to develop closer connections with their customers and agents. Insurance firms may better serve their consumers and remain competitive in the industry by utilizing Salesforce’s benefits.